Maximum Profit: MAXIMUS Extracts Excessive Profits from State Contracts

MAXIMUS’ large profit margins on its state contracting business and recent executive comments raise questions about whether the company is reaping unfairly high profits from state agencies. MAXIMUS reported profit margins of 18.6% on its state and local contracting business for the first quarter of FY2020, more than double its 8.6% margin on its federal government contracts in the same quarter.[1]

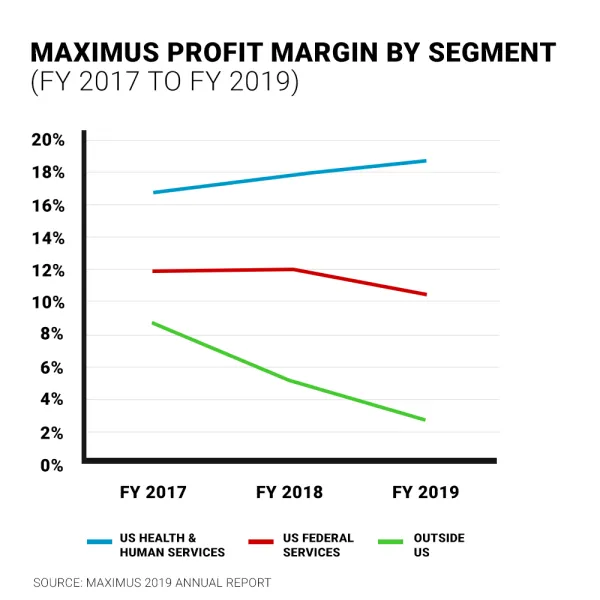

The eyebrow-raising profit margins on state contracts last quarter were not an isolated occurrence, but the continuation of an ongoing trend. The graph below shows MAXIMUS’ profit margins between FY2017 and FY2019 on its state contracting, which it refers to as its US Health and Human Services segment, as compared to the company’s margins on its contracts with the federal government [2] and its business outside the United States. MAXIMUS’ profit margins on state contracts have been consistently and significantly higher than on its federal government contracts. Since the first quarter of FY2019 for example, its state contracting profit margins have hovered between 17.9% and 19.6%, almost double its margins on federal contracts, which have fluctuated around the 10% mark in recent quarters.

Such outsized profit margins on state contracts raise questions about whether states are adequately negotiating with MAXIMUS to ensure that taxpayer dollars intended for health and human services are being spent responsibly. Every extra dollar that goes to boost MAXIMUS profits is one less dollar invested in improving the quality and availability of critical services.

Recent comments from the company’s Chief Financial Officer Richard Nadeau further suggest that state agencies could be doing more to control costs on their contracts with MAXIMUS. Nadeau told investors this month that “we generally try to bid in the area of 10% to 15% over the longer-term for [state] contracts.”[3] This suggests that some states are getting a bad deal in their contracts with MAXIMUS given that the company’s overall margins on its state business have regularly approached 20% in recent quarters.

State officials—including both contracting and oversight officials—may be able to save taxpayer dollars by subjecting existing MAXIMUS contracts to scrutiny. For example, New York State has saved $75 million by renegotiating a contract with MAXIMUS for call center services for its state health programs [4] after audits identified “excessive ” profit fees, questionably high general and administrative fees, and other improper billing practices.[5]

Recent company statements following MAXIMUS’ acquisition of a large federal contact center business in November 2018 suggest that some states may now be overpaying on contracts that include selling, general and administrative (SG&A) fees. According to MAXIMUS leadership, the acquisition served to “spread [SG&A costs] over toward the Federal group and away from U.S. Health and Services.”[6] In doing so, the federal acquisition “provided a benefit to our operating profit margins in [our US Health and Human Services] segment through the absorption of a greater share of indirect costs.”[7] This suggests that states may now be footing a disproportionate portion of the company’s SG&A costs on its existing MAXIMUS contracts following this acquisition. The company estimated that the acquisition boosted profit margins on its state contracts by between one and one-and-one-half percentage points.[8]

In addition to seeking potential cost savings on existing MAXIMUS contracts, state agencies should be vigilant when negotiating the final terms and pricing of contracts and extensions awarded to MAXIMUS. Such negotiations are an opportunity for agencies and officials to ensure that taxpayer dollars are being used to serve the public--rather than creating excessive corporate profits for MAXIMUS.

This brief is the second installment in the Government Contractor Accountability Project’s series examining MAXIMUS’ government contracting practices and their impacts on both the public and workers. The first installment, “Maximum Harm: MAXIMUS’ Medicaid Management Failures,” can be read here.

Endnotes

[1] US. SEC, Form 10-Q: MAXIMUS, Inc. (Feb. 6, 2019).

[2] MAXIMUS reports certain state-based appeals and assessments work under its US Federal segment. See U.S SEC, Form 10-K: MAXIMUS, Inc., at 7 (Nov. 26, 2019).

[3] MAXIMUS, 2020 1st Quarter Earnings Call (Feb. 6, 2020). Accessed via S&P Capital IQ.

[4] Letter from the New York Office of the State Comptroller (Aug. 6, 2019).

[5] OSC, “Re: Report 2014-STAT,” letter dated May 6, 2014. See also OSC, “State Contracts by the Numbers: 2017 Calendar Year, OSC Contract Review Protects Taxpayer Dollars,” at 3-4, March 2018. See also OSC, “Re: Report 2014-STAT,” letter dated April 23, 2015.

[6] MAXIMUS, 2020 1st Quarter Earnings Call.

[7] U.S SEC, Form 10-K: MAXIMUS, Inc., at 24.

[8] MAXIMUS, 2019 1st Quarter Earnings Call (Feb. 7, 2019). Accessed via S&P Capital IQ.